The parameters of a deal between Paramount Global and Skydance Media continue to be ironed out in talks between the companies this week. Negotiations proceeded despite open resistance from a block of Paramount shareholders.

Negotiators have set a timeline to finalize the terms of the deal in May. Paramount overall is being valued at $5 billion, with $2 billion flowing to its current controlling shareholder National Amusements, whose president is Shari Redstone, and the remaining $3 billion applied towards paying down Paramount’s outstanding debt. Current Skydance CEO David Ellison would become CEO of the new company and former NBC Universal CEO Jeff Shell would become its President.

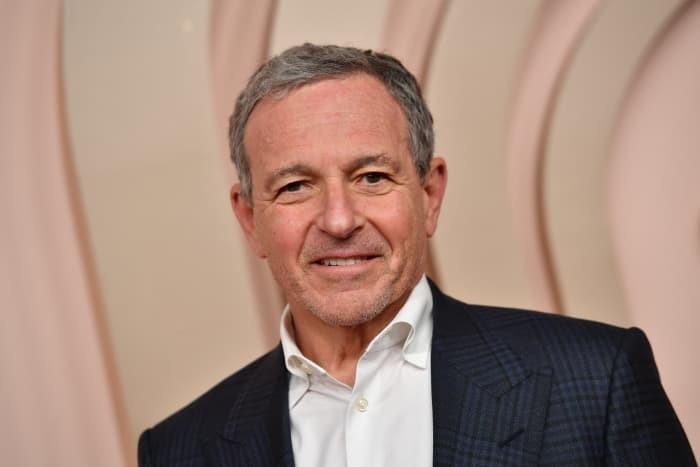

Reports this weekend indicate that current Paramount CEO Bob Bakish will leave the company soon after his eight years at the helm. While there are still competing proposals from other potential acquirers, it appears that most Paramount insiders prefer the Skydance deal because it would allow Paramount to remain a publicly traded company, as opposed to the primary competing offer from Apollo Global which would result in the company becoming privately held.

As talks progress, significant obstacles remain. Perhaps the most difficult challenge is finalizing a renewal agreement with Charter Communications, the second-largest cable provider in the U.S. Paramount’s current deal with Charter expires at the end of April. It remains quite unclear how these negotiations will turn out, with Paramount’s current effort to reorganize and sell its business up in the air and Q1 earnings due to be released on Monday, April 29th.

Charter has shown a willingness to use hardball tactics in its negotiations with content providers, including an ugly stand-off with Disney last fall that led to a temporary suspension of ESPN, ABC, and all of Disney’s cable channels from the Charter network. In that case, the two sides came to a deal after 10 days of suspension, with Disney acquiescing on most of Charter’s demands.