Gower Street Analytics estimates 2023 Global box office hit $33.9 billion through December 31. This represented a +30.5% gain in 2022, continuing global box office recovery.

However, it remains -15% behind the average of the last three pre-pandemic years (2017-2019). Gower Street also recently estimated that due in part to a strike-impacted release calendar, 2024 is projected to drop slightly to $31.5 billion (a -7% drop from 2023).

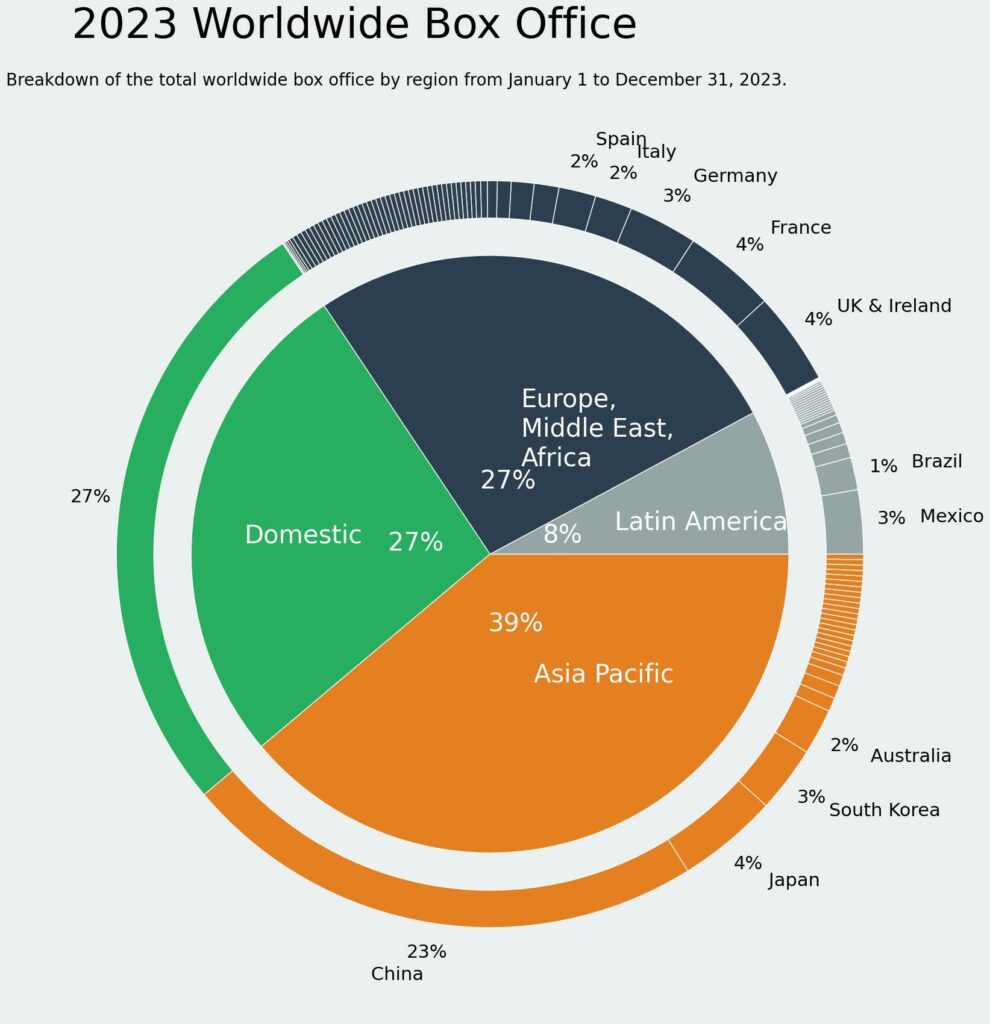

According to the latest data from our partners at Comscore Movies, the Domestic market remained the top global market in 2023 with an estimated $9.07 billion, up +21% year-on-year, but still -21% behind the 2017-2019 average. It accounted for 26.8% of the Global result, down from 28.9% in 2022.

The International market (exc. China) delivered an estimated $17.1 billion in 2023, a similar +20% gain in 2022 but tracking slightly better against the 2017-2019 average (-15%), in line with the Global deficit. After a last-minute boost from the Dec. 30 release Shining For One Thing, China is estimated to have finished at $7.71 billion, gaining 83% in 2022 and finishing just -6% behind the 2017-2019 average.

The results show both Global and International (exc. China) results finishing within 6% of Gower Street’s 2023 Projection published for CinemaCon in April 2023, which had Global at $32.0 billion and International (exc. China) at 16.2 billion.

At that time Domestic was estimated to reach $9.0 billion and China $6.8 billion. Gower Street announced that revised projection on April 23, just 5 days after members of Hollywood’s Writers Guild of America (WGA) voted to strike and nearly three months before the Actors’ strike also came into effect.

Following a summer fueled by triumphant Hollywood hits Barbie and Oppenheimer as well as a stronger-than-usual summer season in China, Gower Street revised its 2023 Projection up to $34.5 billion in September, with Domestic raised to $9.2 billion, International (exc. China) to $17.0 billion, and China to $8.3 billion, now taking into account a much-changed Q4 release-calendar, impacted by the strikes.

This brought International (exc. China)’s projection to within 1% of the final result. Likewise Domestic remained at 1% of the final result. However, a disappointing Golden Week holiday period in October in China meant that that market was, once again, the biggest challenge to accurately predict.

Within the International market, the three key regions all made year-on-year gains. Europe, the Middle East, and Africa delivered just shy of $9.0 billion, a +25% gain in 2022 but, in line with Global and International results, was -15% behind the 2017-2019 average.

The EMEA region accounted for 26.5% of the Global box office, a slight dip from 27.7% in 2022. Asia Pacific (exc. China) is estimated to have made a more modest gain of +9% year-on-year to $5.5 billion. With China included the region accounted for 38.9% of Global sales, up from 35.6% in 2022, but this was fueled by China’s surge from 16.3% in 2022 to 22.8% in 2023.

Without China, the region looks to have fallen from 19.3% to 16.1% of Global sales. This is in part due to more modest year-on-year gains in some key markets, such as Japan, which had seen a stronger recovery in the previous year. Latin America is estimated to have delivered $2.66 billion, a +32% gain in 2022 and a modest -8% deficit against the 2017-2019 average.

Excluding India (for which Gower Street/Comscore does not have complete tracking) the top 15 International markets are estimated to be: China ($7.71bn), Japan ($1.48bn), UK/Ireland ($1.36bn), France ($1.35bn), Germany ($1.01bn), South Korea ($0.97bn), Mexico ($0.94bn), Australia ($0.67bn), Italy ($0.55bn), Spain ($0.54bn), Brazil ($0.47bn), Netherlands ($0.36bn), Russia ($0.33bn), Saudi Arabia ($0.25bn), and Argentina ($0.21bn).

Although there were points in the year when several major international markets, including China, Japan, and Germany, were tracking ahead of their pre-pandemic 3-year averages the only top 15 market to finish 2023 ahead of its 2017-2019 average was The Netherlands (+3%).

There were however strong signs that global audience levels had returned to pre-pandemic levels in the summer, with both July (+17%) and August (+1%) posting business tracking ahead of the 2017- 2019 averages for those months globally. July was also the first post-pandemic month to witness the Domestic, China, and International (exc. China) markets all outperform their 2017-2019 average simultaneously (+10%, +7%, and +53%, respectively).

This showed that, where a competitive release calendar and attractive content were on offer, the audiences were there. Please note: Percentage comparisons for 2023 against 2022 and pre-pandemic years are based on like-for-like local currency numbers converted at current exchange rates for greater accuracy.