On Thursday, Disney dropped a blockbuster fourth-quarter earnings report, sending Disney’s share price to its highest single-day increase in more than three years. Results across the board were better than expected, with losses narrowing in the company’s streaming business and profits increasing in most other areas.

Results were improved through the implementation of aggressive cost controls and a series of price increases across the company’s various streaming services. Revenue was flat for the company overall, with gains in streaming offset by losses from linear TV.

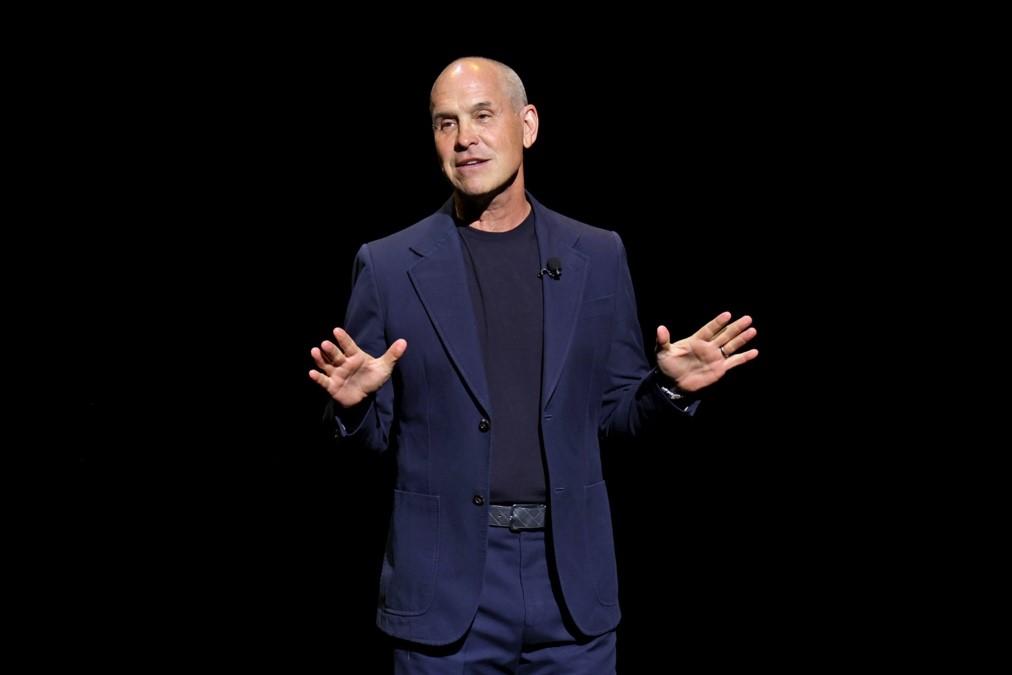

The market’s positive reaction was further enhanced when Disney CEO Bob Iger announced a series of new initiatives, including a $1.5 Billion investment in Epic Games, the acquisition of Taylor Swift’s ERAS concert film to play on Disney+ exclusively, an upcoming theatrical release of MOANA 2 in November 2024 and a new partnership between ESPN, Fox and Warner Bros. to create a streaming service focused on live sports programming.

One wonders whether these announcements responded to pressure from Disney’s shareholders, who are facing an upcoming vote to choose members for the company’s Board of Directors. Over the past several months, activist investor Nelson Peltz has been making a public case that the company has underperformed significantly and badly needs a new direction.

While Iger’s announcements may have been timed to refute this argument, Peltz responded that he wasn’t buying it. Peltz said last month, “It saddens me that the board didn’t welcome me. This company is just not being run properly.” When asked about his relationship with Peltz, Iger said he hasn’t spoken with him in “some time” and has no plans to change that.